The Enterprise Planning Cloud (EPBCS) comes with four prebuilt business processes:

- Financials

- Workforce

- Capital

- Projects

Each of the business processes comes with several prebuilt business rules. Some of these rules are written by Essbase calc scripts, and others are written by Groovy. Now let’s take a look at the majority of the prebuilt rules by business process and cube. Most importantly, we would have a better understanding of their use cases.

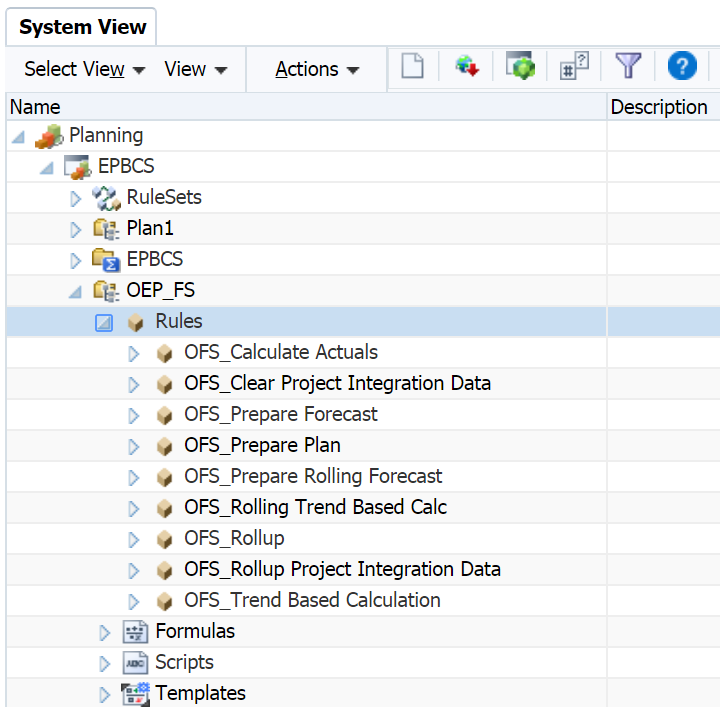

Financials – OEP_FS Cube

OFS_Calculate Actuals: Calculates drivers and aggregates data. Run this rule to ensure that you’re working with the latest figures and calculations.

OFS_Calculate Cash Flow: Used for Cash Flow Direct only. Calculates Cash based on the sources and uses of cash.

OFS_Prepare Forecast: Copies selected months of Actual results to the Forecast scenario and recalculates drivers and trends based on the new periods of actual results. You can also use this rule when rolling over to a new year as the starting point for a forecast.

OFS_Prepare Plan: Calculates Plan based on the trends and drivers set up in the application. Use this to either create or update a plan or use this as a starting point for rolling over to a new year.

OFS_Prepare Rolling Forecast: Similar to OFS_Prepare Forecast; use when the Rolling Forecast feature is enabled.

OFS_Trend Based Calculation / OFS_Rolling Trend Based Calc: Rules are run on save for driver and trend forms to calculate accounts based on the selected trend. OFS_Rolling Trend Based Calc is available only if Rolling Forecast is enabled.

OFS_Rollup: Roll up values for any scenario (actual, plan, forecast or rolling forecast). Run this rule when you want to see values at the top of the dimension hierarchy.

OFS_Rollup Project Integration Data / OFS_Clear Project Integration Data: Use when integrating Financials with Projects.

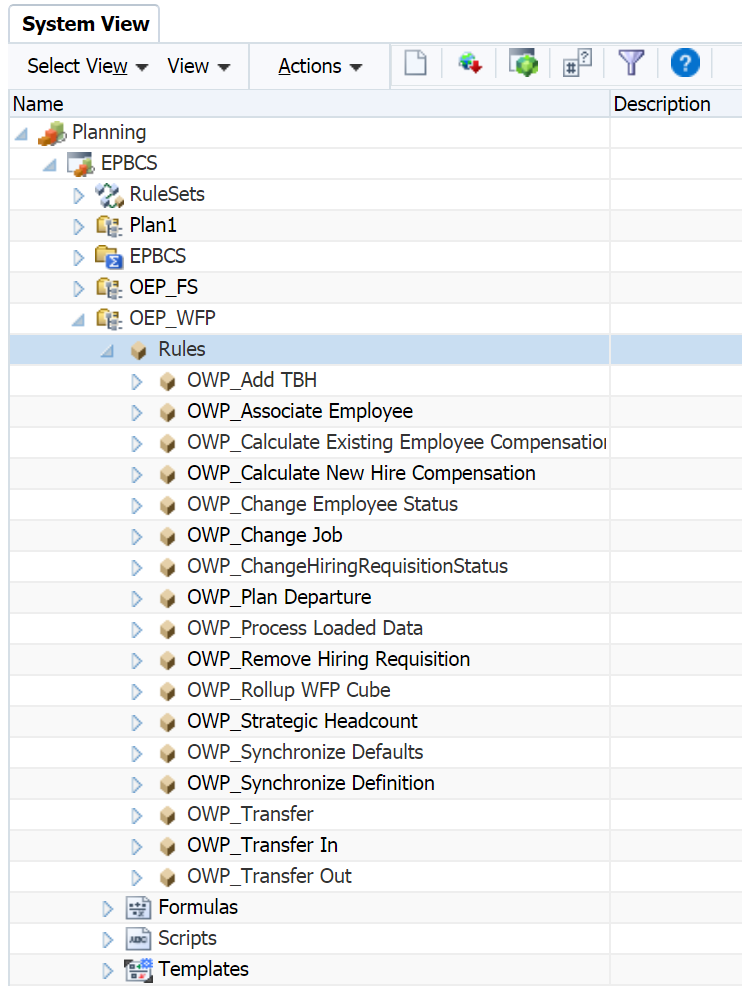

Workforce – OEP_WFP Cube

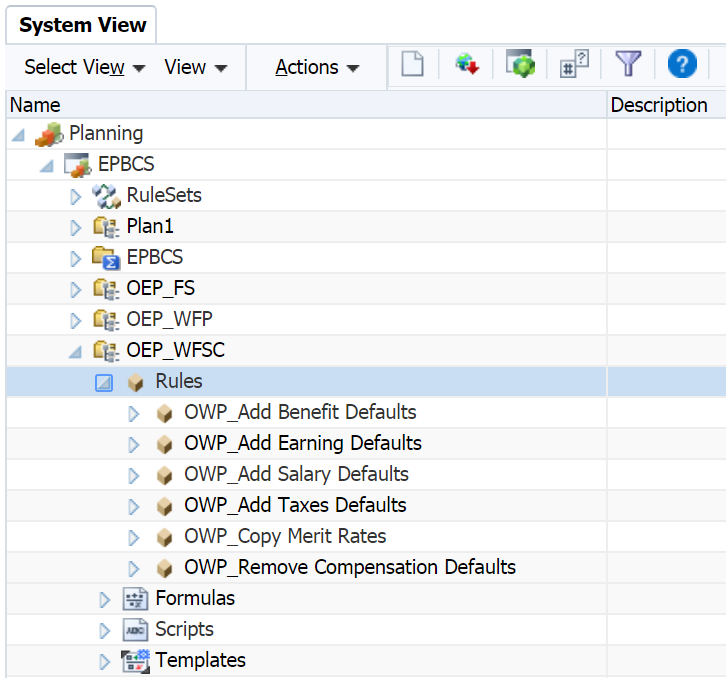

Workforce – OEP_WFSC Cube

Synchronize Defaults: Run this rule after you update the entity defaults for a benefit, tax, or additional earning. For example, you set up a new benefit or removed an existing benefit from entity defaults. Running this rule from the New Hires or Manage Existing Employees form pushes the updated entity default at the employee-job level. If you launch Synchronize Defaults using the right-click menu, you use it for a selected employee-job combination.

If you intend to execute the Synchronize Defaults rule for:

- Only one person, highlight the row containing that person’s name, and then run the rule.

- Multiple people, or to select the dimensionality with a runtime prompt, highlight a blank row and then run the rule.

Synchronize Component Definition: Run this rule after you update an existing benefit, tax, or additional earning. For example, you updated a rate table, payment frequency, salary grade, or maximum value. Running Synchronize Component Definition pushes the updated component definition to employees and jobs. This rule doesn’t update the entity defaults.

Calculate Compensation: When you update data on a form, to recalculate expenses, run the Calculate Compensation rule. For example, if you change an employee’s status, review that employee’s FTE, and then run Calculation Compensation.

Process Loaded Data: After you import new data, run the rule Process Loaded Data to copy the data to the necessary periods in the planning year range. Running this rule copies the information from the substitution variables OEP_CurYr and OEP_CurMnth.

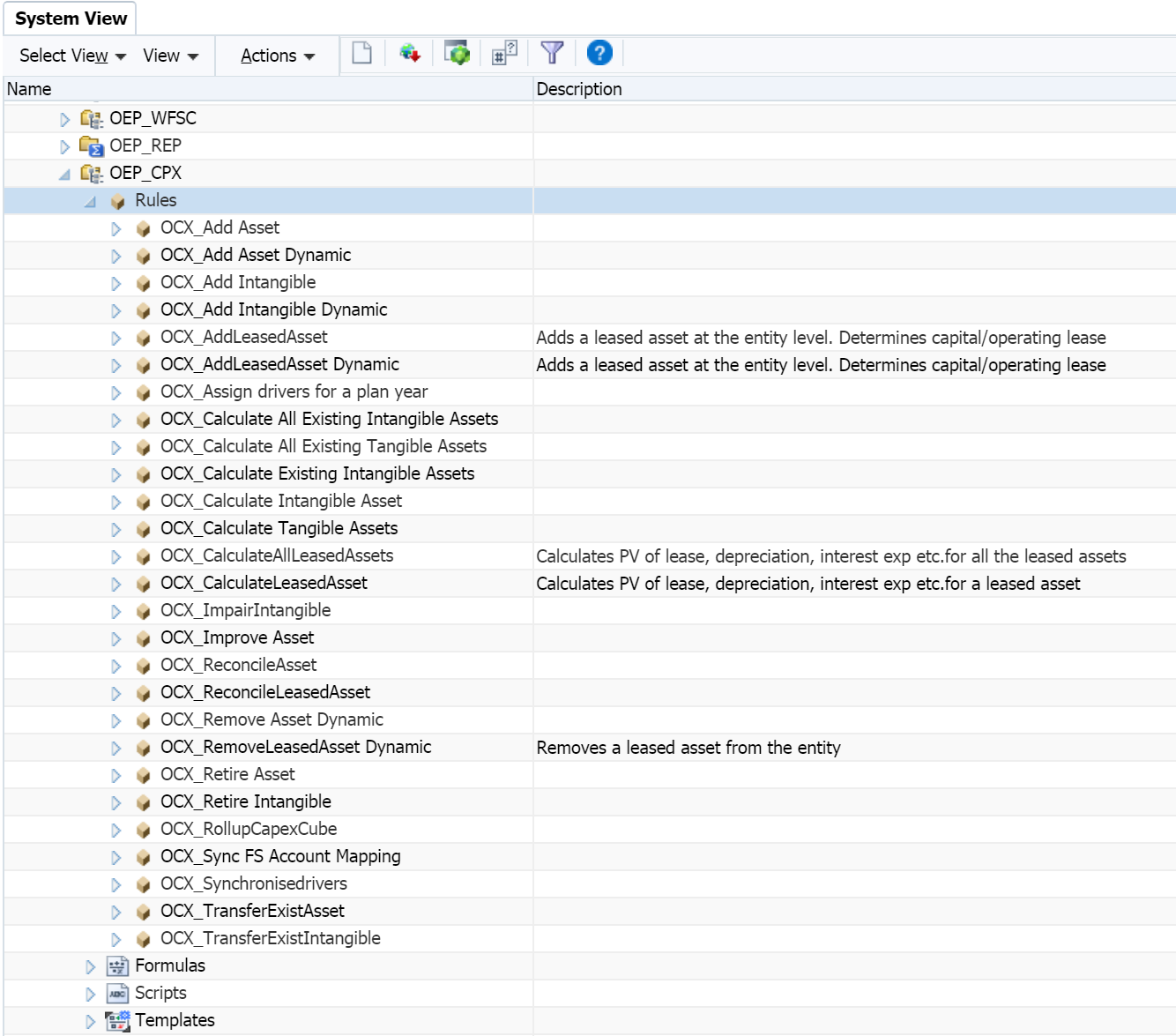

Capital – OEP_CPX Cube

OCX_ Add Asset: Adds new assets for asset class; for tangible assets.

OCX_Add Asset Dynamic: Adds new assets with member names given in the run time prompt.

OCX_Add Intangibles: Adds intangible assets for asset class.

OCX_Add Intangibles Dynamic: Adds new assets with member names given in the run time prompt.

OCX_Add LeasedAsset: Adds leased assets including determining whether it’s operating or capital lease.

OCX_Add LeasedAsset Dynamic: Adds leased asset with member names given in the run time prompt.

OCX_Calculate All Existing intangibles: Calculates the amortization and all other expenses and cash flow for all existing intangible assets in an Entity.

OCX_Calculate All Existing tangibles: Calculates the depreciation and all other expenses and cash flow for all existing tangible assets in an Entity.

OCX_Calculate Existing Intangible Asset: Calculates the amortization and all other expenses and cash flow for the specified existing intangible asset.

OCX_Calculate Intangible Asset: Calculates the amortization and all other expenses and cash flow for the specified intangible asset.

OCX_Calculate Tangible Asset: Calculates the depreciation and all other expenses and cash flow for the specified asset.

OCX_Calculate All Leased Assets: Calculates PV value of lease, depreciation, interest, and cash flows for all leased assets for an entity.

OCX_Calculate LeasedAssets: Calculates PV value of lease, depreciation, interest, cash flows for a specified leased asset.

OCX_ImpairIntangible: Calculates impairment (reduction of asset value) for intangibles.

OCX_ImproveAsset: Allows for adding improvements to existing assets by splitting the asset and creating the value of the improvement.

OCX_ReconcileAsset: Reconciles the new asset request against an existing asset. All values are pushed to the assigned asset.

OCX_ReconcileLeased Asset: Reconciles the new leased asset request against an existing leased asset. All values are pushed to the assigned asset.

OCX_Remove Asset: Removes a planned asset investment that is no longer relevant.

OCX_Remove Asset Dynamic: Removes a planned named asset investment that is no longer relevant.

OCX_Remove Leased Asset: Removes a planned lease asset investment that is no longer relevant.

OCX_Remove Leased Asset Dynamic: Removes a planned named leased asset investment that is no longer relevant.

OCX_Retire Asset: Retires the existing asset, where the asset can be sold or written off, with corresponding accounting implications.

OCX_Retire Intangible: Retires the existing intangible, where the asset can be sold or written off, with corresponding accounting implications.

OCX_RollupCapexCube: Rollup of all the asset-related costs, expenses, and cash flows across the hierarchy.

OCX_Sync FS Account Mapping: Syncs the mapping of financial statement accounts between Capital and Financials.

OCX_Synchronize drivers: Syncs drivers.

OCX_TransferExistingAsset: Transfers assets from one entity to another; all costs/expenses are pushed to the new entity.

OCX_TransferExistIntangible: Transfers intangibles from one entity to another; all costs/expenses are pushed into the new entity.

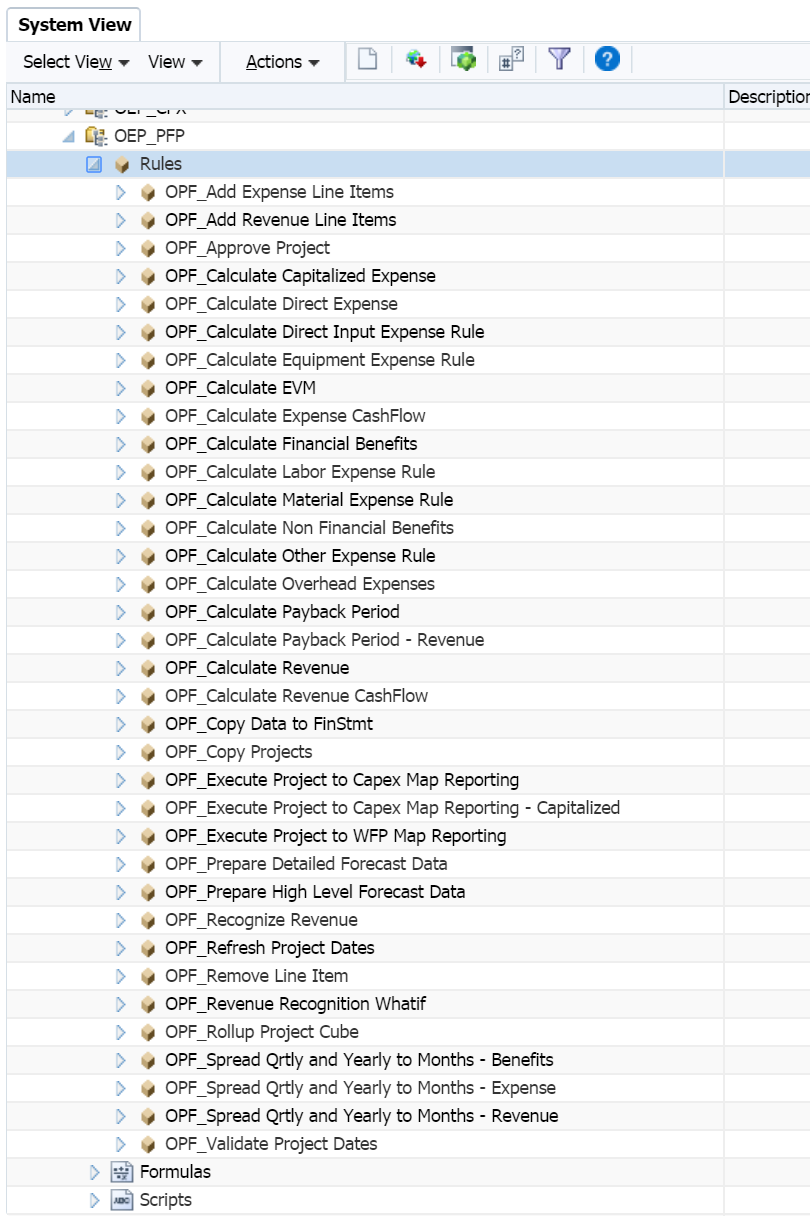

Projects – OEP_PFP Cube

OPF_Add Project: Adds a new project on the fly.

OPF_Add Expense Line Item: Adds a new expense line item in a project.

OPF_Add Revenue Line Item: Adds a new revenue line item in a project.

OPF_Approve Project: Sets the status of the project to Approved; copies the plan data to the forecast scenario, since this project is likely to move forward.

OPF_Calculate Capitalized Expense: Calculates capitalization expenses for capital projects.

OPF_Calculate Direct Expense: Calculates direct expenses for all projects.

OPF_Calculate EVM: Calculates Earned Value Measure for Project – Schedule and Cost variance based on set targets.

OPF_Calculate Expense CashFlow: Calculates cash flows associated with expenses, based on the assumptions set for the project.

OPF_Calculate Expense: Calculates driver-based expenses for labor, material, and equipment based on set driver-based assumptions.

OPF_Calculate Financial Benefits: Calculates aggregated financial benefits.

OPF_Calculate Non Financial Benefits: Calculates non-financial benefits, summing the year totals.

OPF_Calculate Overhead Expenses: Calculates overhead expenses based on the specified drivers.

OPF_Calculate Payback period: Calculates the payback period based on the expenses and benefits planned for a project.

OPF_Calculate Payback period Revenue: Calculates the payback period based on the expenses and revenue for a project.

OPF_Calculate Project Benefits:Calculates the project benefits for indirect and capital projects.

OPF_Calculate Revenue: Calculates revenue for contract projects based on the project type: time and material, cost plus, or direct.

OPF_Calculate Revenue cash flows: Calculates the cash flows for revenue realization.

OPF_Calculate Revenues: Calculates revenues.

OPF_Copy Data to Finstmt: Moves data from Projects to Financials after aggregating data for all projects, based on the defined mapping.

OPF_Delete Project: Deletes the project.

OPF_Execute Project to Capital Map Reporting: Creates capital assets from project expenses.

OPF_Execute Project to Capital Map Reporting – Capitalized: Creates capital assets from project expenses based on resource class.

OPF_Execute Project to WFP Map Reporting: Moves assigned job codes and employees FTE, labor hours, and expenses to Workforce.

OPF_Prepare Detailed Forecast Data: Organizes data for forecast for months and years.

OPF_Prepare High Level Forecast Data: Organizes data for high level forecasts for months and years.

OPF_Push data to capex from Projects: Moves data into planned capital work in progress assets based on allocated expenses from Projects to Capital.

OPF_Recognize Revenue: Calculates revenue recognition based on the assigned revenue recognition drivers.

OPF_Refresh Project Dates: Run this rule before directly entering expenses or revenue for projects that have been imported, or when project dates are changed.

OPF_Remove Line items: Removes line items from the project.

OPF_Rollup Project Cube: Calculates the aggregation of projects through the hierarchy.

Roll up Project: Aggregates the projects and pushes the data to Financials based on the account mapping.

Hope this post explains some use cases for the pre-built business rules. I would like to spend more time on the Groovy rules in the future posts. Till next time.

Hi, for PFP, I see there is a rule in the text of your post for “OPF_Add Project” but it is not in the screenshot of calculations. Is there a reason it is missing?