From a business perspective, Periods 1 to 12 are the twelve months of the year. Period 13 is the year end adjusting period which would have adjustment GL entries booked into it. So for all reporting purposes, period 13 also needs to be taken into consideration and merge into December to get the actual balances.

The reason we use period 13 is, usually it is necessary to continue making entries in the previous accounting year, even though we are now in our new accounting year. The reason for this is that there will always be a slight delay in administrative routines. For instance, goods that were delivered at the end of December are usually invoiced a few days into January, etc. Besides, we rarely post year end entries until a little into the following year but this should not prevent us from making daily entries and continuing as usual. We cannot risk having to postpone entries for the new accounting year until the previous year’s Year End is complete.

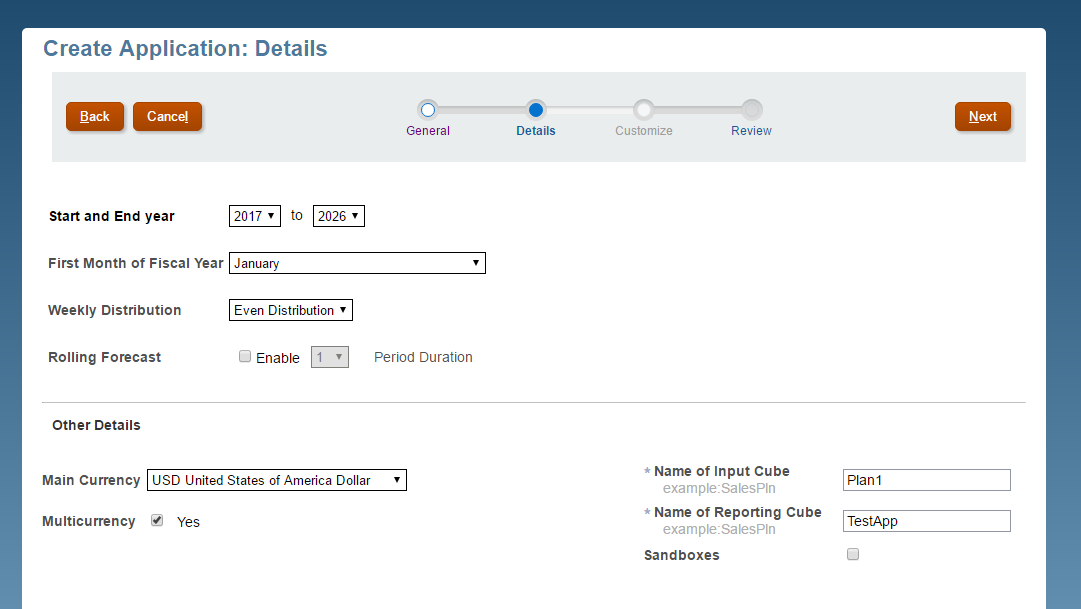

In PBCS/EPBCS, when we create application, we don’t have an option to select 12 periods or 13 periods.

EPBCS Application Creation

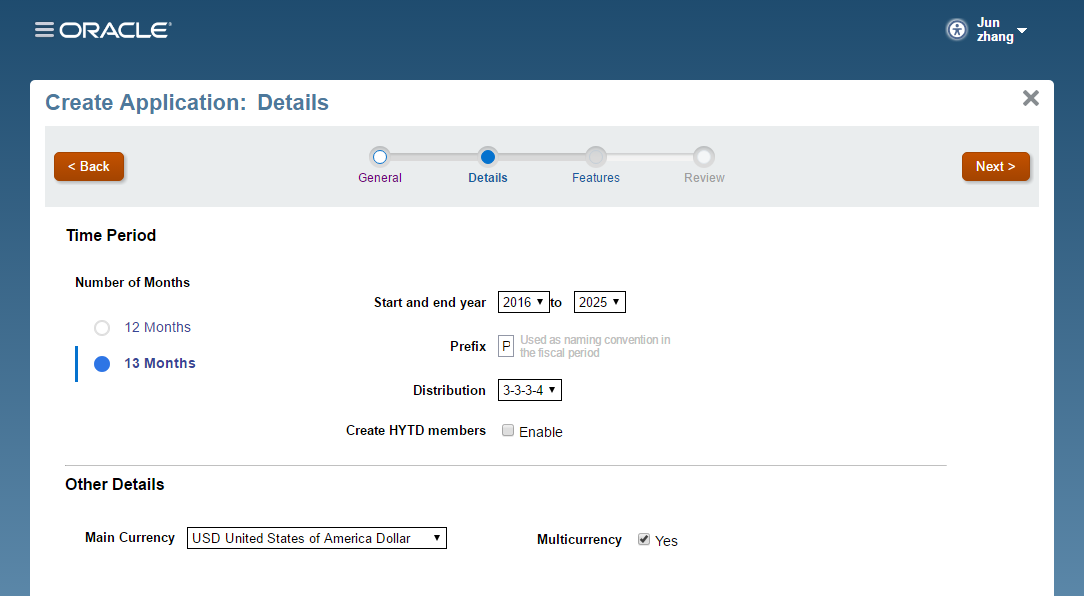

In FCCS, when we create application, we have the option of selecting 12 Months or 13 Months.

FCCS Application Creation

Now I will only focus on PBCS/EPBCS, and will discuss how to use the period mapping in FDM to manage the Period 13 data.

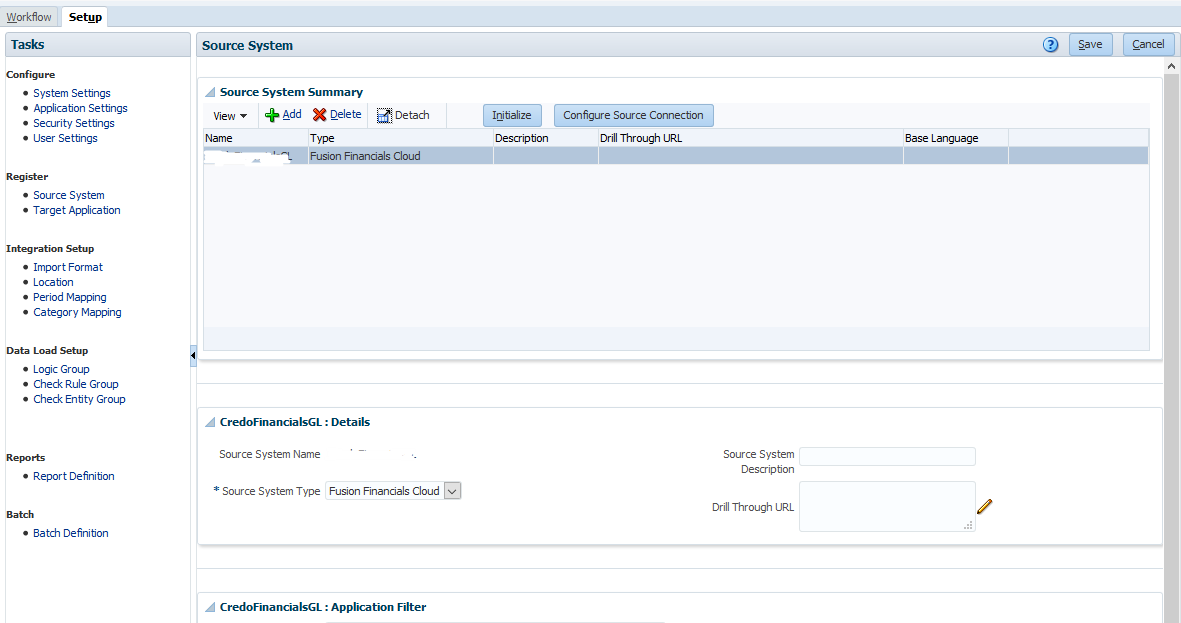

In FDM, if we are using Fusion Financials Cloud with EPM Cloud end to end seamless integration, we can load data directly from fusion ERP. This integration allows us to simply pick the desired source ledger from the Fusion GL cloud, set up a few simple mappings and then push a button to pull the data into the EPM Cloud applications. This integration can be run manually, or scheduled for a specific time, and does not require manual steps in the Fusion Financials Cloud or the EPM Cloud services.

Since we don’t have a “period 13” member in the period dimension in PBCS, we will need to update the period mappings.

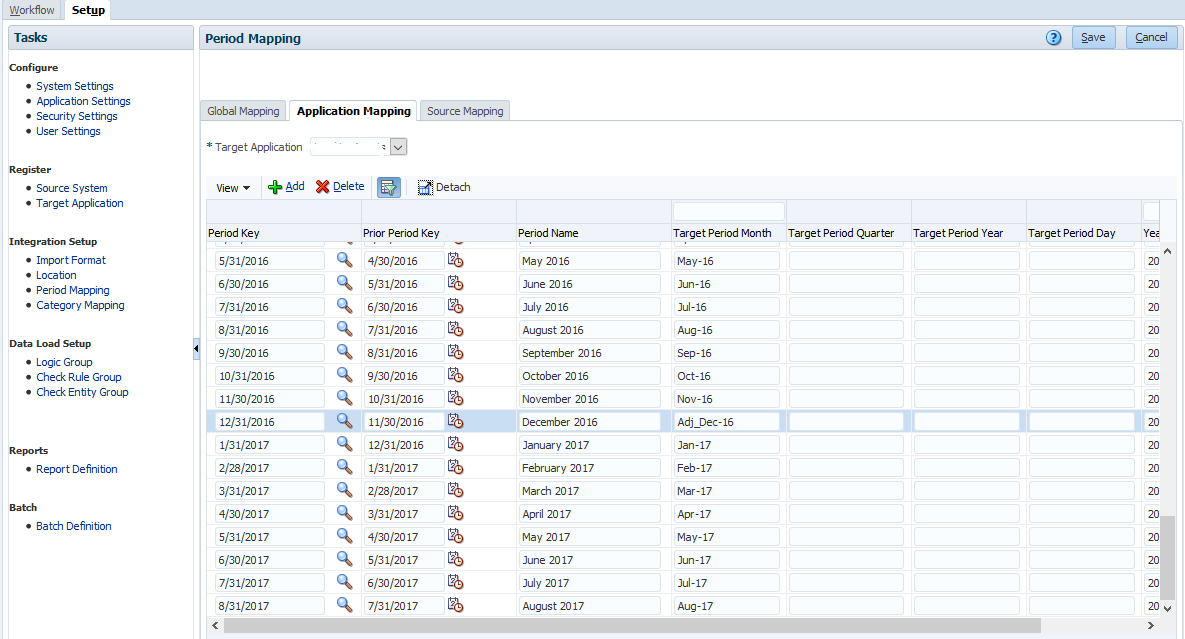

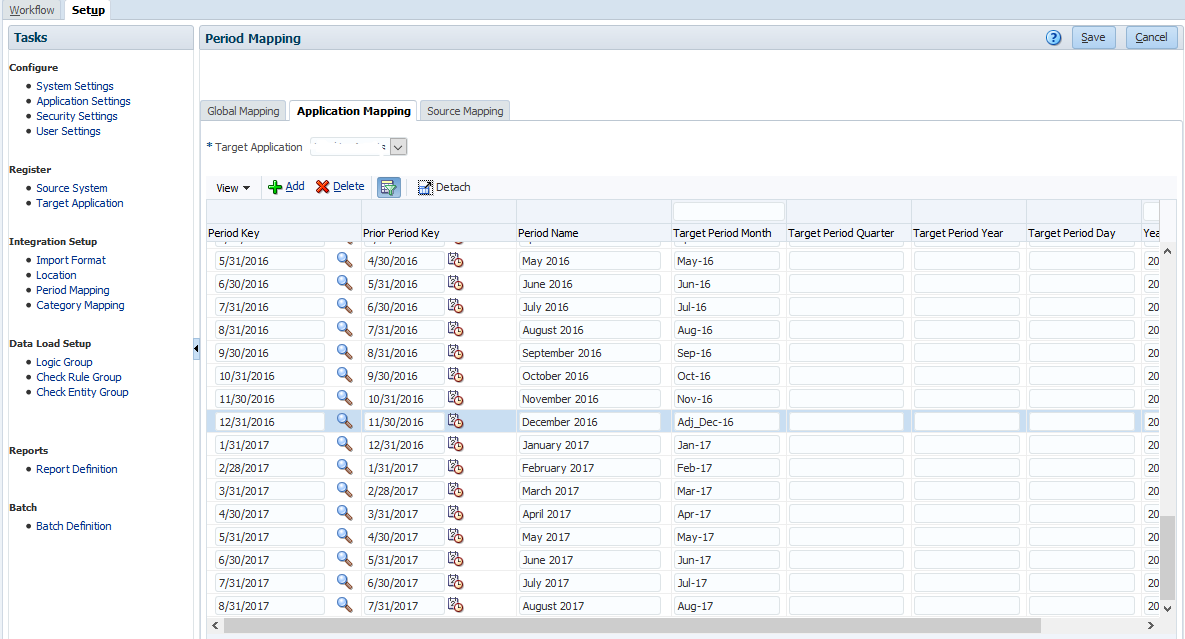

Under Setup -> Integration Setup, we will need to update the Application Mapping. Select December 2016, and change the Target Period Month to “Adj_Dec_16” (This will depend on the period 13’s name in the Fusion ERP application.)

The tricky part is, since we need to load Balance Sheet accounts for “Ending Balance” from Fusion ERP, and load Income Statement accounts for “Period Activity” from Fusion ERP, we will need to change this for the Balance Sheet accounts load rule only. Mathematically speaking:

Ending Balance for December + Period Activity for Period 13 = Ending Balance for Period 13 = Begin Balance for January next year

When we load the Income Statement accounts, we will keep using the period mapping as “Dec-16”.